Opening a self-directed IRA and investing in precious metals is barely extra sophisticated than opening a standard IRA or Roth IRA. When you fall considerably behind in your payments, your custodian may very well be capable of sell some of the treasured metals in your account with a purpose to pay delinquent charges. Do I pay taxes after i transfer into a Gold IRA? All IRAs (Conventional IRA, Roth IRA, SEP IRA, Simple IRA, Solo) are eligible for direct rollover. Put the informational supplies and agency data to work for you. Prices change so fast within the valuable metal world that the firms would reasonably offer you cost details when you attain out to a representative than have you discover some outdated figures on an internet site - its own or one other company’s. Some plans do enable for investment in a restricted choice of in style stocks, together with in some instances treasured metals ETF’s like GLD and SLV. ETF like GLD which is just backed by a pool of gold holdings and positions. The ETF owns the gold whereas the investor purchases shares in the fund, which commerce according to gold’s market value. What is the distinction between investing in a Precious Metal IRA and proudly owning a Treasured Metallic ETF?

Do you have to Open a Valuable Metallic IRA? top gold ira companies are additionally know as a ‘precious metals IRA’; under IRS regulations, self directed IRAs are allowed to put money into 4 sorts of metals, specifically gold, silver, platinum, and palladium. To hold gold in an IRA, you should create a self-directed account, administered by a specialist custodian who handles and shops the metal. The school and researchers fought unsuccessfully to keep away from handing over tapes of the second IRA interviewee, Dolours Worth, who died last yr. Investors ought to do their very own research on services and phone a monetary advisor earlier than opening accounts or transferring cash. Contemplating that the 401k is probably the most prevalent sort of eligible retirement plan, it’s what we’ll focus on in this article.

This text initially appeared on the non-public finance website NerdWallet. As its webpage states, “Maintaining an virtually flawless status profile is no easy activity.” Nonetheless, Regal Assets stays in excessive regard through a consumer-first approach. Goldco offers gold IRA buyers with storage choices, full with chopping-edge safety, in Delaware, Utah, and Texas. These services must have IRS approval. Whereas you may discover many other gold IRA investment companies on the market, these companies have excellent reputations, in depth experience out there, and client evaluations showcasing phenomenal service. Really, historical past reveals that the first gold coins were struck in Lydia, a area of western Turkey at present, round 600 BC. Accredited gold investments should fall underneath a pre-accredited listing (as detailed above), be pure 24-karat gold bullion bars (1 oz - four hundred oz.), and secure an acceptable hallmark from a professional refiner or assayer. The treasured metal products need to issue from a nationwide authorities or different certified manufacturer or refiner. We rated every gold IRA supplier on a selection of factors including status, annual charges, valuable metal choice, and gold IRA reviews. Different administrators will charge different quantities, however the typical is roughly $50 for this particular category of fee. Learn the IRS publications 590-A & 590-B for additional details.

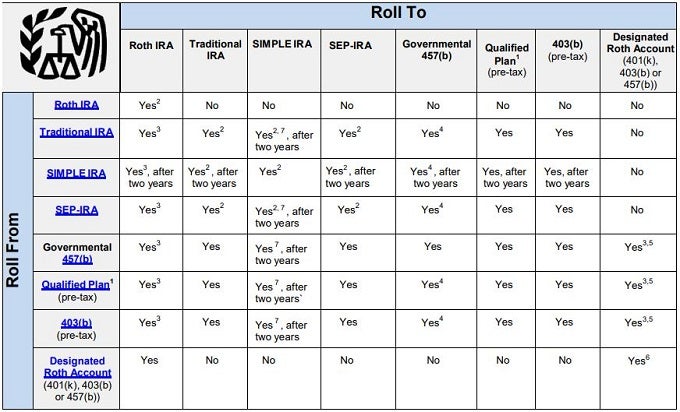

Rules pertaining to 401k plans can range as dramatically as the businesses sponsoring them, but some typically widespread parts include rollover alternatives when: the sponsoring firm substantially modifies the plan, the sponsoring firm adjustments the managing custodian, or the worker quits, retires, or is terminated. What forms of IRAs are eligible to switch or rollover? Prospects incessantly buy gold and different valuable metals for quite a lot of causes. What Treasured Metals Are you able to Spend money on for Retirement? The inner Revenue Service imposes strict regulations on the treasured metals you possibly can choose for your gold IRA. Investors usually use valuable metals as an extended-term hedge against inflation, to diversify their portfolio.